tax is theft bitcoin

Similarly theft losses used to be tax deductible. However theft losses were also affected in the tax reform.

Japanese Bitcoin Law Lenz Karl Friedrich 9781502353030 Amazon Com Books

Tax attorney Steven Chung shares how fraud victims can use theft loss deductions to offset ordinary income.

. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more. If cryptocurrency such as Bitcoin is stolen by hackers tax relief may also be available. For instance single taxpayers making up to 41675 will pay no long-term capital gains taxes.

Bitcoin became a news sensation in 2017 when its value. The point of saying that taxation is theft is to remind people that it may be a necessary evil to pay for police roads etc but still an evil so has to be minimised. To arrive at the deductible amount 100 plus 10 of your Adjusted Gross.

The question here is if you can deduct the losses at your cost basis when your coins were stolenhacked from exchanges or wallets. So if youve lost your crypto. Best Tax Software.

In all cases organized books and records are a necessity. 22 hours agoUnderstanding whether Bitcoin is a safe investment depends on how you define security. Crypto theft and scams are on the rise but only some of these losses are tax-deductible.

Tax is theft bitcoin Sunday June 26 2022 Edit. Your gain is the amount youll be obliged to pay taxes on. Cryptocurrency Is Treated As Property.

In this scenario your cost basis is 10000 and your gain is 5000. Unfortunately worthless ICO tokens may be treated as capital losses not theft losses even more so if SEC has the intent to classify some of these tokens as securities. Tax Rules for Bitcoin and Others.

If you owned your bitcoin for more than a year you will pay a long-term capital gains tax rate on your profit which is determined by. Under the current tax law this situation is a personal casualty loss which is no longer tax-deductible. Please login or register.

Lets take a look at how to report stolen scammed and lost tokens on your taxes. Latest Bitcoin Core release. Casualty Loss - ex.

Cold wallets are also subject to theft or loss. New York defines bitcoin sales tax the same way by finding the value of the cryptocurrency or CVC used at the time of purchase and applying that to the value of the CVC amount spent. Unfortunately in most cases you wont be able.

April 12 2022 045942 PM. The city of Curitiba in Brazil is now studying the possibility of accepting cryptocurrency payments for taxes. Noemia Rocha a city councilor for Curitiba presented this.

Single taxpayers making between 41676 and 459750 will pay 15 and single. Its estimated that 90 percent of all remote hacking is now focused on bitcoin theft by commandeering other peoples. Tax is theft bitcoin Monday October 17 2022 Edit.

But how much tax do you have to pay. If you have suffered losses as the result of theft. Lost Wallet Access Sent to Wrong Address Theft Loss - ex.

ExchangeWallet Hacked Stolen Coins Investment Loss - Gray area ex. Taxes are theftare they. With 247 trading and investment minimums as low as 10 its so easy to get started.

The tax code only allows you to write-off a portion of your theft loss as opposed to the full amount. They are now no longer tax deductible.

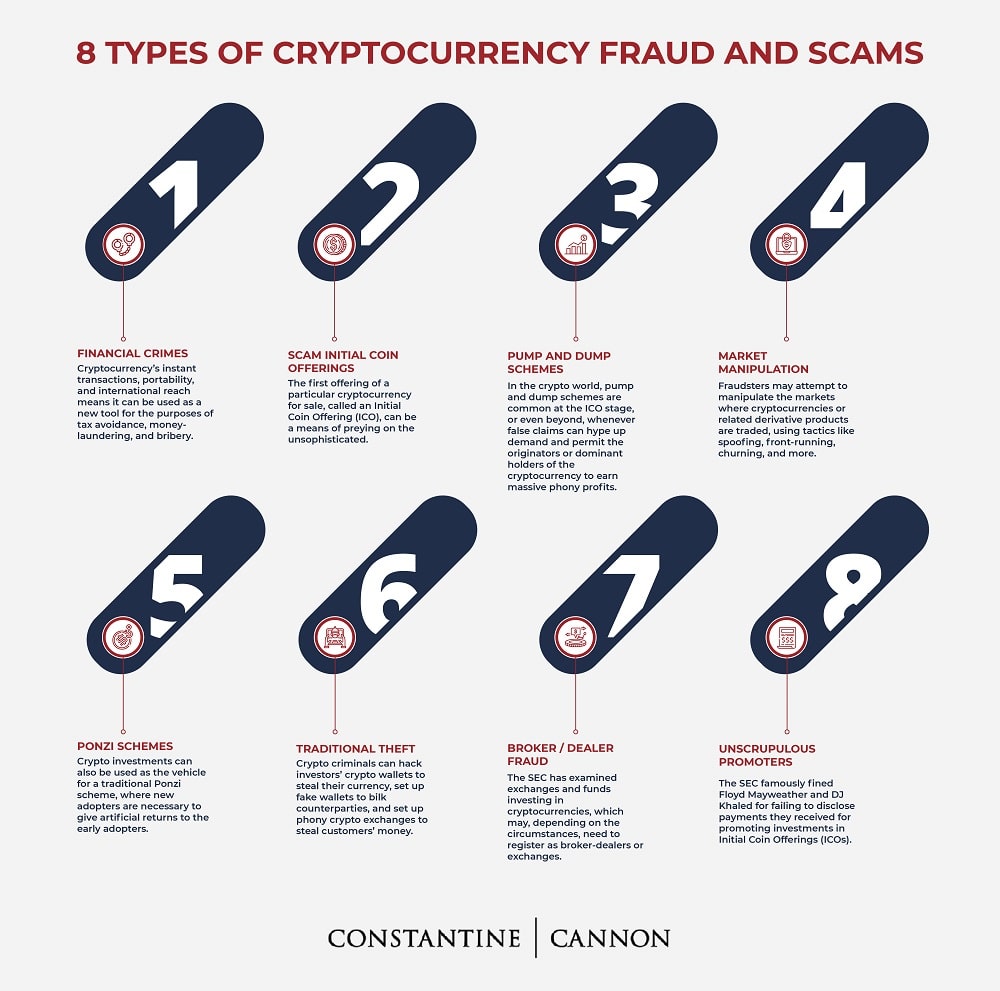

Cryptocurrency Fraud What You Should Know Constantine Cannon

Crypto Tax Crypto Platforms Introduce New Products As Investors Explore Ways To Save Tax The Economic Times

Your Crypto Tax Guide Turbotax Tax Tips Videos

Cryptocurrency Tax Calculator Forbes Advisor

Do You Pay Tax On Lost Stolen Or Hacked Crypto Koinly

Crypto Taxes How To Calculate What You Owe To The Irs Money

Crypto Tax 2021 A Complete Us Guide Coindesk

What Tax Preparers Need To Know About Digital Currency

Cryptocurrency Taxation Here S What You Need To Know Cnn Business

Taxation Is Theft Archives Bitcoin News

Tax Implications Of Stolen Cryptocurrency Or Nft A Toronto Tax Lawyer Analysis

Uk Tax Agency Defines Crypto As Commodities

How To Serve Your First Cryptocurrency Tax Client Cointracker

.jpeg)

How To Report Crypto Losses And Reduce Your Tax Bill Coinledger

What Are 2022 Cryptocurrency Taxes Forbes Advisor

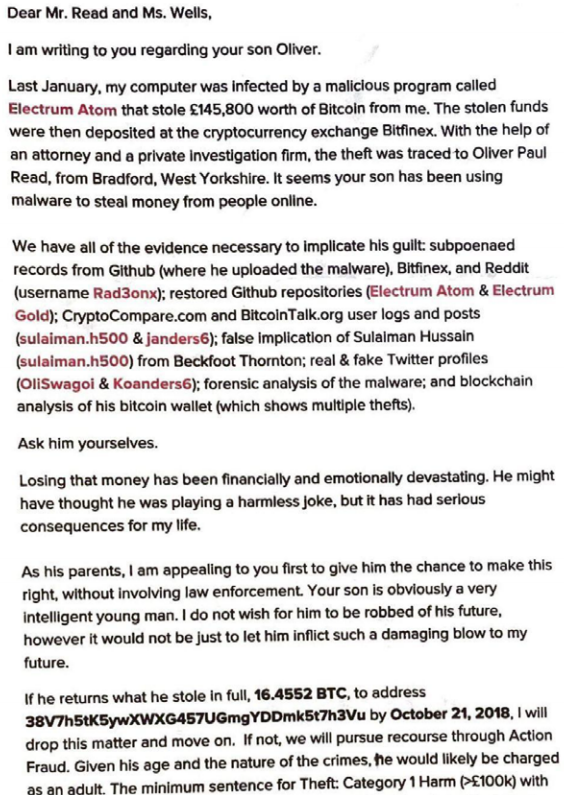

Man Robbed Of 16 Bitcoin Sues Young Thieves Parents Krebs On Security

How Is Cryptocurrency Taxed Forbes Advisor

.jpg)

How To Report Crypto Losses And Reduce Your Tax Bill Coinledger